1 whole BTC is now becoming increasingly unaffordable for most people. Infact, by the end of this year 1 BTC will be unaffordable to most. People will need to start thinking in satoshis. 1 BTC=100 million satoshis. Its a bit like, buying gold, one does not need to buy a kg of gold, you can buy it in small ounces and fractions of ounces. This is where the ETF's come in, they remove unit bias. Investors will be buying 1/1000th of a whole BTC (my estimate, to be determined).

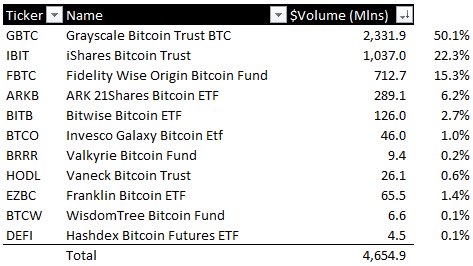

See the BlackRock ETF Price

Below are some factors which will impact BTC (collated from Twitter).

ETF ad campaigns: Super Bowl ads coming, as well as a barrage of high quality ads

Nation-state adoption : Jan3 CEO has been working on nation state adoption of BTC. Small nations are looking into it.

The Halving: This decreases supply by 50 %, come April

Veblen Effect: BTC gets more desirable as the price increases, BTC is a veblen good.

118x Multiplier: The exact multiplier is unknown, but each $ in BTC multiplies the price by an X factor, Bank of America said its 118!.

Recursive Demand Shock™

Low $BTC supply on exchanges

Max Pain Theory

Renewed QE: Fed may ease rates or increase liquidity in 2024

FASB: This is an accounting standard change, which allows companies to hold BTC and account for taxes in a simpler way. This is HUGE.