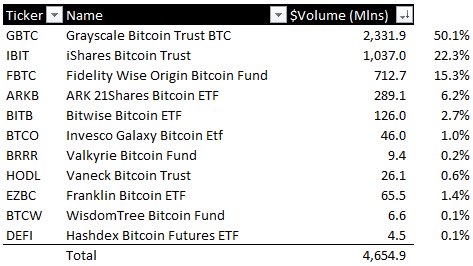

Here's a chart of the BTC supply schedule. the columns to watch are the Decimal(BTC) and the Date column. It can be seen that since 2020 the miners are mining about 6.25 BTC every 10 min, or 900 BTC/day. In 3 months that reward becomes half, i.e they get only 3.125 BTC/10 min, or 450 BTC day. This is a very limited new

supply to be shared with the whole world, by 2028 the supply completely shrivels up, to 225 BTC/day. In other words there is very little new supply, its like Gold mining stops, the only gold that is available is already with Central Banks/Retail. For comparison, currently US ETF's are buying

(demand) about 10,000 BTC/day. Furthermore,

between 2028-2140 a period of 112 years the last 3 % of all BTC will be mined, i.e. there is literally no new BTC being mined.

Folks dont realize that when the price of Gold goes up, mining activity increases (supply) since there is still a ton of gold underground. With BTC there is absolute scarcity, the number of total coins cannot be increased.

Not many understand the above school level math !, but by the time they do, BTC will be much higher.