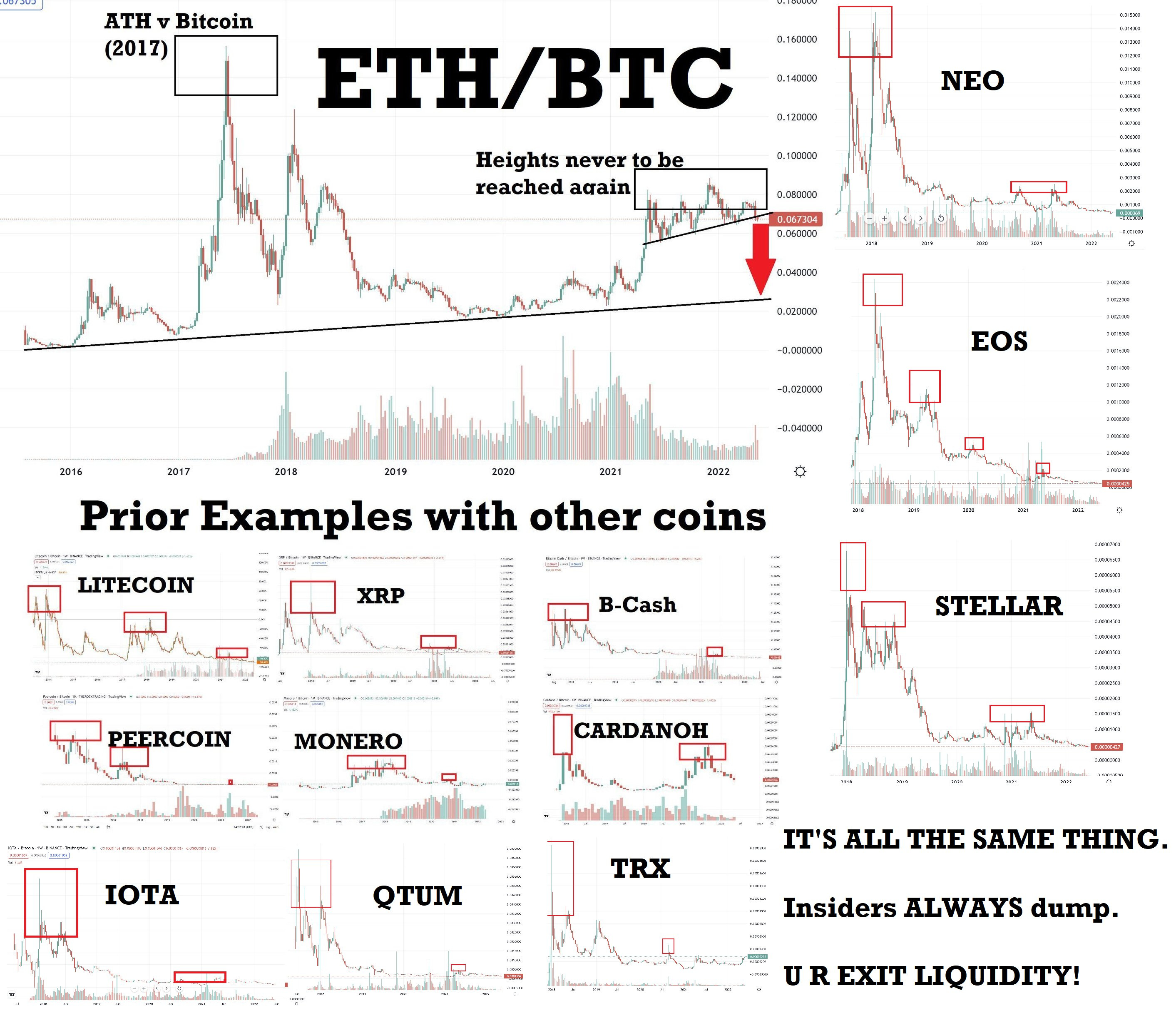

Many $hitcoins are going to Zero this time, Luna, Hex and Celsius are a few examples. They are not coming back. History repeats.

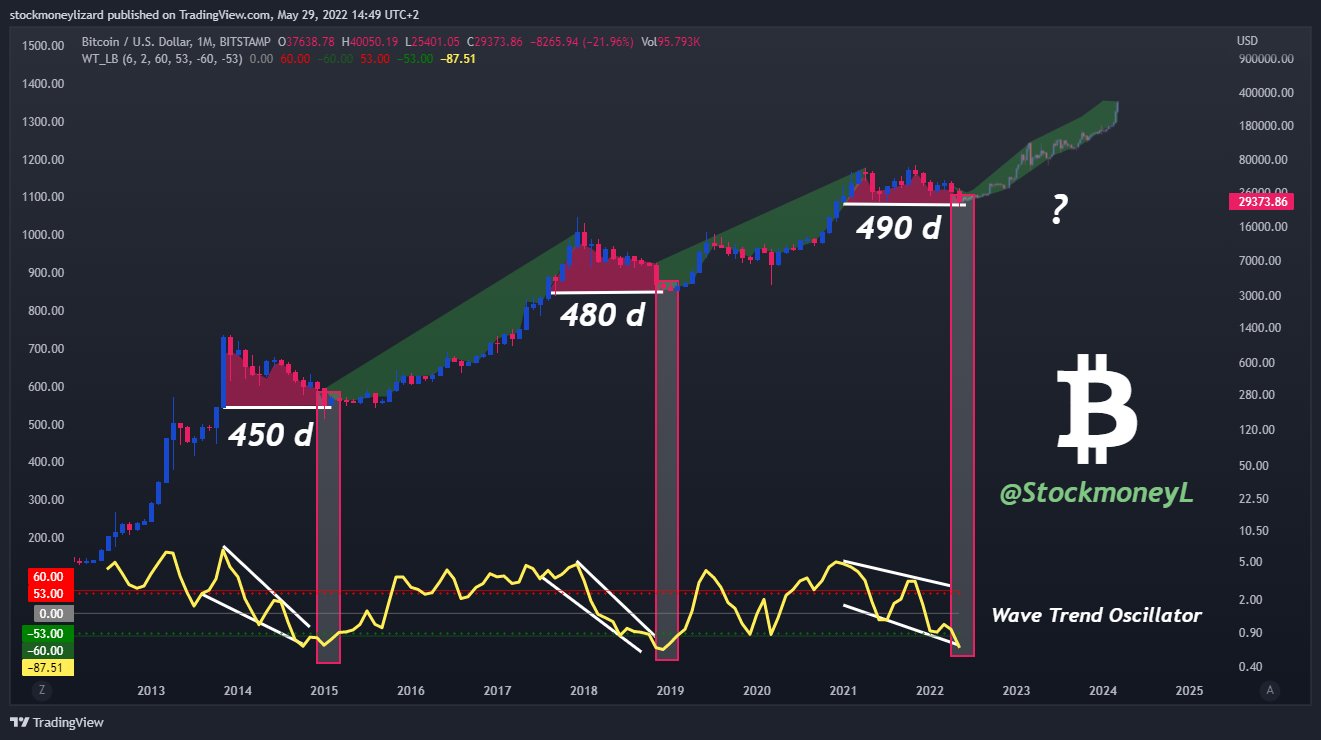

BTC needs some time to mature, note what is happening to the BTC supply, very little supply will come over the next few years. Infact after 8 years, practically speaking no more new supply and anything new that is available, will likely be balanced by people losing their keys!. Patience is the name of the game. Several billionaires like Michael Saylor and Bill Miller in the US, Ricardo Salinas in Mexico and others have significant BTC holdings. OTOH, BTC demand is increasing world wide, with many jurisdictions making it legal tender. When demand increases and supply cannot meet it, prices go up. That is the reason you are seeing BTC hold its price around 29K, while the $hitcoins are going to zero. BTC could still go down to 22K, but it has never in its history gone below a previous all time high (20K). So, I wait and buy more, anytime I have some spare cash.

https://twitter.com/i/status/1530506101774376960