We all worry, when BTC goes down. However, the more you understand about BTC, the easier it is to not get shaken off.

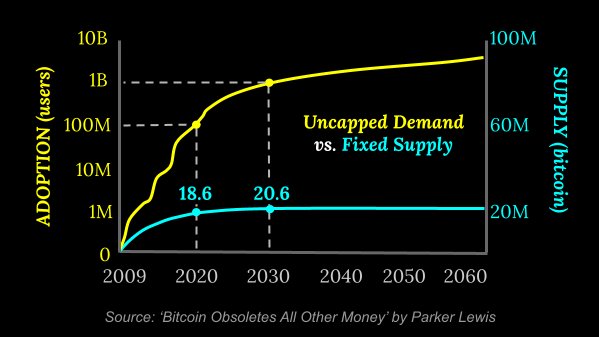

1. Look at the Supply Demand for BTC. Currently about 100 million users, expected to rise to 1 Billion over the next 5-10 years, per various estimates, i.e. 10x increase in demand. 90 % of BTC has already been mined, over the next 8 years (two cycles), the new supply will go from the current 6.25 BTC/10 min to 3.125 BTC/10 min in 2024 and 1.5 BTC/10 min 2028. ie after 2028 98 % of BTC has been mined, i.e. there is no significant new supply the remainder will be mined in even smaller amounts until 2140. In otherwords, demand >> supply, so price must go up.

2. In Q1 2022, El Salvador is coming out with their Volcano Bond, which is expected to be heavily oversubscribed. They will use half the money for BTC mining using renewable geothermal energy and the rest to make Bitcoin City, which will have no income or property taxes. If succesful, more such bonds will be issued.

3. ElSalvador has BTC as legal tender, the prez of El Salv has tweeted that he expects 2 other countries to make BTC legal tender in 2022. At the very least other S.American countries that use the US $, will also start using BTC and even perhaps make it legal tender.

4. The US cannot indefinitely postpone a spot BTC ETF. If that happens, BTC goes parabolic. Already Canada, Brazil, Europe have such ETF's. Fidelity has started to invest in the Canadian ETF, that is money drain out of the country.

5. Many rulings from IRS, SEC etc suggest that BTC is not going to be banned, that means the US has decided to live with BTC. This was a big threat over BTC, its been mitigated.

6.

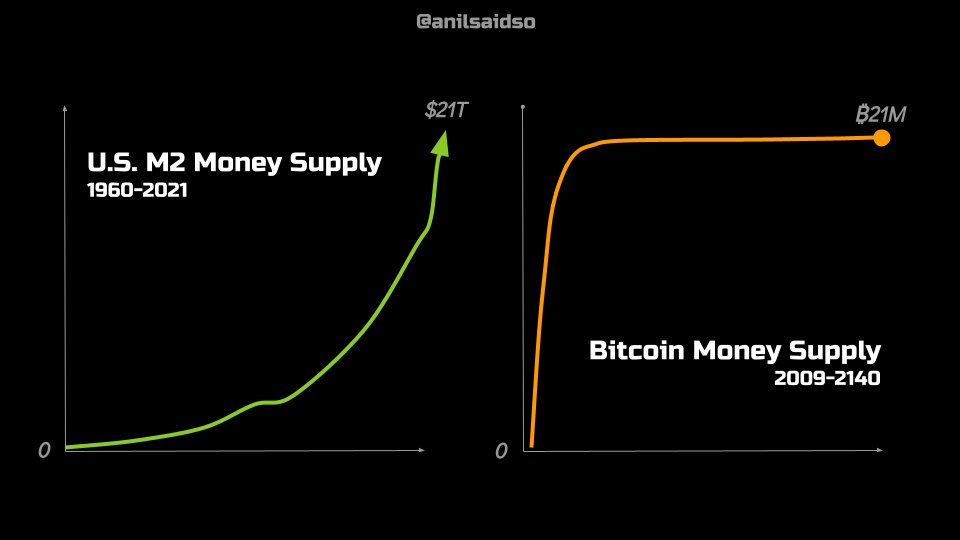

Smart people say that money printing cannot be stopped, otherwise the markets crash. So M2 will increase, whereas BTC supply is capped. People including many billionaires such as Ray Dalio, Bill Miller, Druckenmiller, Tudor Jones, Michael Saylor are holding significant amounts of BTC in their personal portfolio.

7. Many companies such as Microstrategy hold BTC in the company's treasury. Cash is considered to be like a melting ice cube, where inflation eats it away. At some point, the big FANG stocks will also get into it.

8. Bonds: there are about 18 Trillion $ worth of NEGATIVE yielding bonds, at some point people will move out from them to get yield. BTC has given about 100 % CAGR average growth for the last 10 years or so.

9. There is enough evidence that Gold is being demonetized, significant amounts of money is moving from gold to BTC, same will happen to bonds, even a 5 % move from bonds to BTC can be quite dramatic.

10. Other assets such as Real Estate, cars, paintings etc which hold a lot of value, these will see flows to BTC. A 5 % flow to BTC from Real Estate will happen over the next few years. That could be massive.

11. Many boomers are retiring and will pass on trillions of $ to their millenial kids, many of whom are believers in BTC.

12. There are literally hundreds of companies, big and small investing billions of $ in BTC. We have not much looked at the so called second layer solutions of BTC. Just today CashApp launched Lightning payments over its app or with Twitter anywhere in the world, instantaneously and near free of cost. STRIKE just introduced a lightning payment service in Argentina, they just finished doing that in El Salv where 90 % of the population now has a Chivo wallet.

https://twitter.com/i/status/1481015254742188032I could go on and on...admittedly some of this is wishful thinking, but there is too much going on for BTC to crash very much. When in doubt zoom out and look at a BTC chart on log scale, its quite a bullish chart.