Good to see more experts weigh in on this. Piketty debunked (again). Inequality is the ladder there for everyone to climb. It isn't a bad thing that people in different careers, at different points in their careers, with different effort levels and different talents get different pay. It's how our most scarce resource, our time, gets allocated best. But it gets measured wrong and then hyped for political and economic folly. I suppose this debate has been going on since Adam and Eve but it restarted in the Bush years as a way of saying a good and growing economy was bad. Mis-measure the differences and then sound the alarm. The point of the deception was to foster dissatisfaction with economic growth and gain support for greater redistribution.

John F Kennedy said a rising tide lifts all boats. He didn't say all boats have to be the same size and travel at the same speed, now matter how small or slow or how vulnerable they would have to be to the next wave.

-----------------------------------------------------------------------------------------------

http://www.the-american-interest.com/2017/01/03/the-inequality-hype/The Inequality Hype

NEIL GILBERT

The great devil of progressives turns out to be mainly a figment of accounting. Better data gives us a more heartening picture of American well-being.

For most of the 20th century, poverty represented the root of all evil to Americans—sprouting criminality, violence, hunger, disease, stunted achievement, and premature death. With the tremendous growth of both the economy and the welfare state over the past sixty years, the political campaign against poverty has almost vanished from the public square. Today, many see economic inequality as the root cause of most, if not all, of our social ills. President Obama described it as the defining challenge of our time—one that threatens “the very essence of who we are as a people.”

It should go without saying that poverty and inequality are not the same. However, it’s worth repeating, because over time a conflation of the two has taken root in common perceptions. The evils once associated with poverty have been transferred lock, stock, and barrel to inequality, whether justifiably or not.

Although political efforts to reduce income (and wealth) inequality do not carry the moral force of religious edicts (leaving aside those for whom Das Kapital has assumed biblical status), they have an intuitive moral appeal not dramatically different from appeals to reduce true poverty—again, since both are seen as causing the same cluster of social evils. Long before any exposure to ideas of social justice one typically hears young children yelling “that’s unfair!” when a pie is divided unequally among them; the quickest to complain are invariably those handed the smallest slices.

And why shouldn’t they? All else equal, there seems to be little ethical justification for one child to get a bigger slice of the pie. As adults we usually make peace with reality by recognizing that it is rarely if ever the case that all else is equal. Karl Marx got around this problem by arguing that the secret expression of value, namely that all kinds of human labor are equal and equivalent, because in so far as they are human, labor in general cannot be deciphered until the notion of human equality has acquired the fixity of a popular prejudice.

For Marx, in other words, all human labor has the same value because we are all equal in what he deems people’s most important characteristic—their humanity. This tautological formulation skirts the issue of how, or even whether, to adjust for merit (and of course it famously leaves out every other factor of production in an economy, but never mind about that for now).

Since classical antiquity the balance between merit and equality has animated philosophical debate about what constitutes a just distribution of material goods. Aristotle believed that a fair and just distribution could not ignore merit, which, once taken into consideration, made a fair distribution essentially an unequal one. He qualified the idea that “equal” is just by differentiating between numerical and proportional equality. The former dictates that everyone gets exactly the same basket of goods, while latter prescribes that the amount of goods received by different people be relative to the amount of effort each contributed to their production. With this deft distinction, Gregory Vlastos observes, “the meritarian view of justice paid reluctant homage to the equalitarian view by using the vocabulary of equality to assert the justice of inequality.”1

Still, the case for reducing inequality made in the political arena appeals to the intuitive sense that fair means equal. All that is being asked is that millionaires and billionaires pay their fair share. This leaves aside the meritarian question of whether they legitimately deserve to possess such vast wealth in the first place. For the most part, proposals to advance equality by taxing tycoons evoke little public opposition. Whether or not targeting this group is really just, many argue that the millionaires can easily afford it. Others question how lawfully the super-rich came by their wealth in the first place, and still others, law aside, assert that all wealth distribution systems are based ultimately on coercion, made necessary by the original sin of private property. The merely progressive as opposed to radical case for income redistribution gains added support from the prevailing assumption that economic inequality is inherently bad because it causes stress, low self-esteem, and a whole raft of dubiously medicalized effects. This assumption reflects the growing tendency to conflate the equality of material outcomes with the incontestable fair-mindedness of equal opportunity.

Champions of increasing economic equality have an emotionally compelling argument that ensures the moral high ground for those making the case. It is not an argument that any sensible politician (or aspiring academician, as opposed to a professional gadfly like the Princeton philosophy professor Harry Frankfurt) wants to enter on the other side.2 Thus in contemporary Western political discourse equality is so thoroughly vested as an abstract good that questions are rarely raised about exactly how much economic inequality is unacceptable, how much is fair, or even how much really exists. The next time someone lectures you about the need to increase equality, you might try asking: How much should we have? As much as Sweden, is one likely response. But inequality has been on the rise in Sweden as in most other industrialized countries, so is the acceptable level that of Swedish equality in 1995 or 2016? Now there’s a conversation stopper for you.

Income inequality is at once a palpable and amorphous condition. That some people have more money than others is a tangible reality. But most people have no idea about the actual distribution of income and their position in the population. An analysis of several surveys of ordinary citizens in nearly forty countries reveals widespread misperceptions about the degree of inequality, how it is changing and where they fit in their country’s income distribution. For example, in the countries surveyed an average of 7 percent of respondents owned a car and a second home, yet on average 57 percent of this group thought they belonged in the bottom half of the income distribution. Among low-income respondents receiving public assistance, a majority placed themselves above the bottom 20 percent of their income distribution. These findings raise serious doubts about the extent to which the median voter knows how much she might lose or gain from redistribution. More important, it means that discontent with economic trends has a lot less to do with perceptions of material inequality than it does with a whole host of other factors that are, as it happens, a lot harder to quantify and therefore much less well appreciated by elites.

Metrics of Inequality and Material Well-Being

In contrast to the normative moral appeals and vague calibrations of fairness in political discourse, the quantitative metrics of social science lend a certain precision to estimates of income inequality. However, these empirical estimates and especially what they signify rest on loose soil that offers fertile diggings for economists and philosophers less interested in facts than in changing facts. To really grasp the essential meaning of economic inequality requires examining how income is measured in relation to demographic changes, geographic differences, and shifting fortunes over the life course. But if that interferes with the propagation of a certain ideological position, then these requirements go unrequited. Let’s look more closely at the facts before we deign to tamper with them.

Income inequality in the United States is generally perceived to have increased over the past thirty years. However, the degree and implications of this trend remain in dispute. The disagreement reflects, in part, differences in the way economists measure inequality, which are rarely aired outside of technical publications. Even when the different measures are reported, what they signify is difficult to discern beyond whether the numbers are going up or down.

The most common measures of inequality include the Gini index and a comparison of income quintiles. They vary in convenience and transparency. The Gini index provides an expedient summary ranging from 0 to 1; zero denotes perfect equality of income and 1 represents a distribution in which one member possesses all the society’s income. Among the advanced industrialized countries Gini coefficients range from .250 to .500. By summarizing the dispersion of income in one number, Gini coefficients are useful for comparative purposes. They clearly show whether economic inequality is increasing or decreasing over time and is higher or lower among countries.

However, the numerical precision veils the existential reality of inequality, particularly in a country as large as the United States. That is, the numbers convey an empirical impression that those with an annual income of $100,000 have a higher standard of living than those with an income of $85,000. If this were not the case, why be concerned about income inequality in the first place?

But in fact it is often not the case. The U.S. Bureau of Economic Analysis documents strikingly large differences in the cost of living throughout the country.3 Thus, for example, when regional price differences are factored in, a $100,000 income in New York State is worth less than an $85,000 income in Montana. Some might argue that it is worth the difference to live in New York. Having come from New York City, like many of my friends I once believed that civilization ended on the east bank of the Hudson. Yet people have different preferences for cultural amenities and natural beauty—and different levels of tolerance for traffic, noise, smog, and cramped apartments. Montanans typically refer to their state as “the last best place,” which may explain the influx of wealthy people over the past few decades. Cost-of-living differences are even more extreme among metropolitan areas. The San Francisco Bay area is almost 40 percent more expensive than Rome, Georgia, a charming locale nestled in the foothills of the Appalachians. Since the cost of living is usually higher in states and metropolitan areas where the average household income is above the U.S. median, the Gini coefficient tends to exaggerate differences in the levels of material comfort and well-being implied by economic inequality.

Moreover, despite the suitability of Gini coefficients for comparing levels of income inequality over time and among countries, the findings expressed by these comparisons can obscure their implications for economic well-being. For example, the .378 Gini coefficient for the United States represents a much higher degree of income inequality than the .257 computed for the Slovak Republic. As for economic well-being, a look at how much money is actually available reveals that the Slovak Republic’s median disposable household income amounts to 29 percent of that of the United States.4 Its middle-class would be on welfare here.

Finally, the Gini coefficient lends numerical precision to the assumption that increasing economic equality is a social improvement. Yet during a recession economic equality as measured by the Gini index may well increase in a country where everyone is getting poorer. Earnings fall for people in both the upper and lower income brackets, but the decline is steeper for those at the higher end who have more to lose in the first place. By the same token, a country could experience rising inequality according to its Gini index when everyone is becoming better off. The rich are getting richer as the poor are also getting richer, just not as much. Rising inequality, however, can also signal that the rich are getting absolutely more and the poor are getting absolutely less. But the Gini coefficient metric by itself is powerless to tell you which is which.

So, are the rich getting richer and the poor getting poorer? A 2012 Pew Research Center survey found 76 percent of the public answered “yes,” which was about the same as the 74 percent who held this view in 1987.5 In contrast to the Gini coefficient, which cannot answer the question, the analysis of income quintiles entails a direct examination of how money is distributed among the different groups, revealing the extent to which their incomes are rising or falling. Calculating the financial resources of five groups that range from the top to the bottom 20 percent of the income distribution, this approach illuminates the economic well-being of families and how they fare over time. But here, too, the results vary according to the alternative definitions of income.

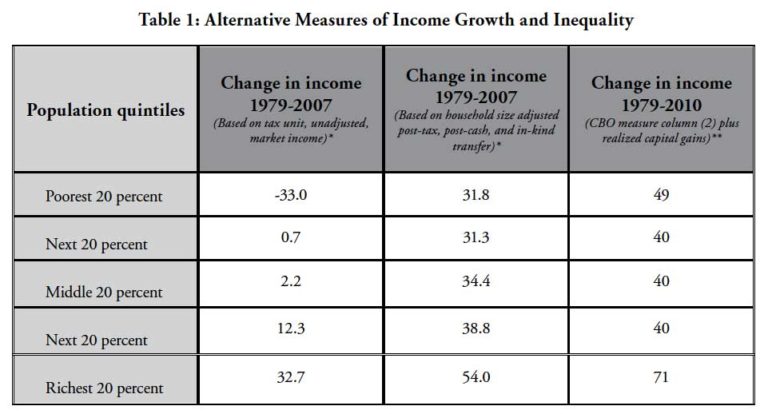

Thomas Piketty and Emmanuel Saez’s well-known study of income inequality in the United States, for example, was based on the market income of tax filers.6 According to this definition, from 1979 to 2007 there was a 33 percent decline in the mean income of those in the bottom quintile in contrast to a 33 percent increase among those in the top 20 percent of tax units. Thus, left entirely to its own devices, the market allocation of income generated a pattern of increasing inequality wherein the rich got noticeably richer and the poor got poorer—a bleak testimony, supposedly, to the distributional problem of capitalism.

However as Richard Burkhauser pointed out in his presidential address to the Association for Public Policy Analysis and Management, the market income of a tax unit is a poor indicator of how much money families actually have to live on.7 A more inclusive measure of the income that remains in households after subtracting what they must pay in taxes and adding the money they receive through government transfers transmits a different image of the American experience. Applying these criteria, instead of a decline we see a 32 percent increase in the mean income of the poorest fifth between 1979 and 2007. (Table 1) Overall, this broader measure still reveals a rise in inequality during that period as the mean income of those in the top bracket climbs by 54 percent.8 But it, too, is incomplete.

Source: * Philip Armour, Richard V. Burkhauser, and Jeff Larrimore, “Deconstructing Income and Income Inequality Measures: A Crosswalk from Market Income to Comprehensive Income” American Economic Review (May, 2013). ** Congressional Budget Office, “The Distribution of Household Income and Federal Taxes, 2010” (Government Printing Office, 2013).

Along with taxes and transfers, the most authoritative and extensive measure of income also incorporates capital gains. Along with Burkhauser and his colleagues, the nonpartisan Congressional Budget Office (CBO) agrees that a comprehensive definition involves the sum of market income adjusted for taxes, household size, cash and in-kind transfers, and capital gains.9 However, the consensus unravels over the issue of exactly how to value capital gains. The basic choice is whether to focus on the total taxable gains realized in the year capital assets are sold or the annual change in value of capital assets whether or not they are sold. This is not just a matter of bookkeeping. The choice to include either realized or accrued capital gains in the calculation of annual income has a considerable impact on the rates of inequality.

The CBO favors the use of realized capital gains that are reported on tax returns. After factoring in the impact of taxes, capital gains, and government transfers the CBO data reveal a sharp decline in inequality compared to when it is measured solely by market income. According to these figures, between 1979 and 2010 the household income in the bottom quintile increased by 49 percent, the income in the middle three quintiles increased on average by 40 percent, and those in the highest bracket increased by 71 percent.10 While incomes increased across the board, the largest gains registered on the two ends of the income distribution. These findings temper progressive arguments that focus on the increasing inequality of market incomes to demonstrate the need for greater social welfare spending.

The income measures cited above all indicate a rising level of inequality that varies only in the rate at which it seems to have increased over the past three decades. In contrast, a different picture emerges if accrued capital gains, which include housing, are substituted for realized taxable gains. This approach yields a reversal of income trends between 1989 and 2007, which shows a decline in inequality as the household income in the bottom quintile climbed at a rate considerably higher than the increase experienced in the top quintile, which was hit much harder by the housing market crash in 2007. Needless to say, the choice between these methods of valuing capital gains is highly contested.

Every pertinent measure of income quintiles, especially the widely acknowledged comprehensive assessment by the CBO, dispels the notion that within the United States over the past three decades the rich have been getting richer as the poor have gotten poorer. The CBO measure reveals that from the highest to the lowest quintile, the mean household income of every group was lifted, even amid a rising tide of inequality. Among the bottom fifth the mean income increased by 49 percent. That’s not peanuts, particularly when we recognize what else is happening.

Another Dimension: Looking Within the Groups

Although the analyses of change since 1979 illustrate the extent to which household incomes climbed while the gap between the bottom and top fifths widened, it’s a one-dimensional picture that discounts what was happening within these economic bands. This image conveys a static impression that the same households within each quintile were experiencing these changes over time. In truth, a lot more was going on among the households within these five divisions, the particulars of which lend depth to the one-dimensional story of increasing economic inequality.

To grasp the full implication of rising inequality in household income, it is important to recognize that during the period in question young workers were continually entering the labor force as the older generation retired and died. A 25 year old who began working in 1979 while living on his own with an income in the bottom 20 percent would very likely reach a higher bracket by the time he was 53 years old in 2007. So not only did entry-level income rise between 1979 and 2007, but over the course of time many of those who started out at the bottom climbed toward the top. In just the period from 1996 to 2005, for example, the U.S. Treasury Department estimates that about half of the taxpayers starting in the bottom 20 percent moved into a higher income bracket.11 Of course, we do not know how many members of this upwardly mobile group were young scions spending their first year out of Princeton as shipping clerks in their fathers’ factory, serving Teach for America in a poor rural area or lolling lazily on the Left Bank—a reminder that numbers can impose a surface on patterns that shields us from the underlying reality.

There is even more to this story. As time passed, the 25 year old got married and had two children. Thus, what started in 1979 as a single-person household in the bottom fifth of the income distribution had morphed into a middle-income household with four people by 2007. This change illustrates an important characteristic of the income quintiles. Although they represent five groups with an equal number of households, the average number of persons per household within these groups varies as do other characteristics such as family structure and employment. The top fifth of households contain 82 percent more people than the bottom fifth. The proportion of married couples in each group ranges from 17 percent in the lowest income quintile to 78 percent in the highest. At the same time, single men and women living alone account for 56 percent of the households in the bottom fifth, but only 7 percent among the top group. And no one was employed in more than 60 percent of the households in the bottom quintile; while 75 percent of the households in the top quintile had two or more earners.

Taking account of the household characteristics within each quintile reveals that to some extent the increasing level of income inequality since 1979 coincides with the changing demographics of family life, particularly the smaller number of persons per household, the decreasing rate at which couples form and maintain stable marriages, and the increasing number of two-earner households. On that score, W. Bradford Wilcox and Robert I. Lerman estimate that 32 percent of the growth in family income inequality since 1979 is linked to the retreat from marriage and the decline of stable family life.12 The point, again, is that economic data are not self-interpreting, and that without a relevant sociological filter they can be made to mean almost anything except what they actually mean.

Concentrating on advances within just the top quintile offers a different perspective, which sharpens our understanding of what is behind the rising level of economic inequality in recent years. Two prominent findings based on the CBO’s all-inclusive measure of income tell the story: From 1979 to 2010 the after-tax income of the top 1 percent increased by 201 percent (compared to the 49 percent increase for households in the bottom quintile and the 65 percent increase for those in the 81st to 99th quintile).13 Research focused on the pre-tax market income of the top 1 percent generates an even higher level of inequality than the CBO findings.

Thus, a disproportionate degree of the increasing level of inequality was due to significant financial gains made by those at the apex of the income pyramid. As for the rest, a careful analysis matching data from the U.S. Census Bureau and Internal Revenue Service demonstrates that after 1993 there was no palpable increase of inequality among the bottom 99 percent of the population. Since the pre-tax incomes of the top 1 percent started at $388,905 in 2011, many of these families would not be considered the super-rich. It’s around the top one-tenth of 1 percent, where pre-tax incomes start at $1,717,675, that we begin to cross the line between relatively well-off and truly affluent.

As soon as the conversation on inequality begins to concentrate on the wealthiest households, the question increasingly comes to mind: What do these people do to deserve such immense rewards? A 2013 study commissioned by the New York Times discloses a median executive pay of $13.9 million among the CEOs of 100 major firms, described by one journalist as a “new class of aristocrat.”14 Although not terribly harsh, this description connotes a privileged class renowned more for its leisure pursuits than its productive labor. But it does suggest how easily personalizing the numbers can transform a dispassionate report on the top 1 percent into bitter accounts of debauchery and corporate corruption. The likes of Bernie Madoff, Tyco’s Dennis Kozlowski, and Ken Lay of Enron supply no shortage of infamy on which to justify a denial of merit. But then there are the brilliant hard-working multi-millionaires who created Apple, Google, and Microsoft, not to mention our favorite movie stars and athletes. Even here some might question why grown men should receive immense sums of money to stand around a few afternoons a week waiting for a chance to hit a ball with a big stick. Major League baseball players were paid on average $3.39 million in 2013. In contrast, for the same activity most minor league players earned between $2,500 and $7,000 for a five-month season—talk about inequality!

Like it or not, in a capitalist system the criterion for reward is ultimately associated with what the market will bear. Of course, many people doubt just how well this standard works in practice. They wonder, for example, how difficult it might be to replace a CEO earning $20 million a year with an equally qualified executive who would accept half that salary. Also, market demand is no guarantee of social value or cultural enlightenment. A writer’s worth varies by the number of readers willing to plunk down the price of a book, regardless of how crass or meaningless the content. Alas, Fifty Shades of Gray has earned millions, while my publishers will be fortunate to clear the all-too-modest advance awarded for Never Enough: Capitalism and the Progressive Spirit. What the market will bear is certainly an imperfect calibration, but most people still think it preferable to having the standard set by bureaucratic quotas or political bargains, though both are often in play, as well.

How Has the Middle Class Really Fared?

Politicians on both sides of the aisle contend that the middle class is being crushed by inequality and diminishing income. But with household incomes increasing amid rising inequality, what do the facts tell us about the real material state of the middle class? There are several ways to answer this question, depending on how the middle class is defined and the benchmarks against which its progress and well-being are measured. The historical absence of an aristocracy has bred a fluid sense of social class and a democratic ethos that instills a degree of reluctance in Americans to identify as “upper class.” Thus, the middle class is a well-regarded, if ill-defined, status to which most Americans subscribe. It is typically associated with one’s income, education, and occupation. Numerous polls capture the propensity of Americans to identify themselves as somewhere along the spectrum of lower-middle to upper-middle class.

When policymakers and the media talk about the middle class, however, it is usually defined by economic divisions. Estimates vary regarding the range of income that delineates the middle class, as well as the interpretation of how the economic fortunes of this group have changed over time. Thus, reviewing the same Census Bureau data the New York Times decries, “Middle Class Shrinks Further as More Fall Out Instead of Climbing Up,” while ten days later the Pew Research Center announces, “America’s ‘Middle’ Holds Its Ground After the Great Recession.”15 Both of these captions are correct and neither highlights the larger story in the data, which only underscores how those who write the headlines may parse the numbers to express the points they wish to publicize. The economic definitions of the middle class in these reports differ: $35,000-$100,000 in the New York Times and $40,667-$122,000 in the Pew study. But the findings are very similar. Both show a substantial contraction of about 10 percent in the size of the middle class, which started shrinking around 1970. Though it sounds ominous, this decline is not necessarily a distressing trend. It depends on where those who were squeezed out of the middle class ended up. If they all moved into the upper income brackets, everyone’s better off.

So where did they go? The answer hinges on the years in question. The New York Times headline focused on the period from 2000 to 2013, the decade of the Great Recession during which the middle class declined by around 2 percent, the upper-income group also declined by about 3 percent, and the lower-income group increased. The Pew caption referred to the period from 2010 to 2013, just after the Great Recession. Over this interval the size of the middle class remained stable, and there was even a small uptick in the upper-income group and a slight decline in the lower-income group.

Despite the fluctuation of a few percentage points during the Great Recession, the larger story in the New York Times report is that between 1967 and 2013 both the lower-income and the middle-income groups contracted while the size of the upper-income group expanded by 15 percent. From this perspective the shrinking of the middle class (and of those in the lower-income bracket) is directly connected to a significant advance in economic well-being as the combined size of the middle- and upper-income groups grew by 5 percent.

Thus, while the New York Times headline evoked a disheartening picture of middle-class decline, the data easily yield a more promising interpretation of the middle-class experience since 1970. The Pew findings offer a somewhat different conclusion, in part because the middle-class definition was pegged at a higher level of income. Although the middle-income group fell by 10 percent, about 6 percent of those who left had climbed into the upper-income category. What a way to go.

Of course, there are other benchmarks against which to evaluate the economic progress and status of the U.S. middle class. Certainly, those concerned about inequality would judge that the middle class has not fared very well in comparison to the income gains realized by the country’s top 1 percent. True; but consider everyone else on the planet. The U.S. middle class boasts among the highest disposable household incomes in the world. The average U.S. family has 38 percent more disposable household income than a family in Italy, 25 percent more than a family in France, and 20 percent more than a household in Germany, when adjusted for differences in purchasing power. (Of course, that doesn’t take fully into account the more efficient provision of many services in Western Europe via the public route: think health care, for example. Which only confirms the point that numbers alone cannot really tell us very much.)

Although some academics invest considerable intellectual energy in debating how to quantify inequality and the significance of change in measures such as the Gini coefficient, most members of the middle class have no idea whether this index is going up or down unless they read about it in the news. And even then the average middle-class citizen is more interested in how much money remains for her family to live on after the give and take of government taxes and transfers than whether or not the Gini index rose or fell by three-tenths of a point.

Could We Ask for More?

Several issues have so far been raised about the divergent approaches to the measurement of inequality, the disparate characteristics of those in different income brackets, the absence of cost-of-living adjustments, the plight of the middle class, the soaring 1 percent, and the sobering revelation of international comparisons. On the whole these issues enable us not so much to dismiss concerns about rising economic inequality as to calm public apprehensions about its rate, degree, and implications. The disparities related to the changing distribution of income in the United States look a lot more acute before taxes and benefits are taken into account, for example—are you listening, Dr. Piketty? As such it can be said that the capitalist market generates and the welfare state mitigates inequality.

Recounted in its most auspicious light, the story of this interaction over the past three decades reveals that while inequality increased, so did household incomes at every level. Measured by disposable household income the U.S. standard of living is among the highest of all the advanced industrial democracies, not to mention the rest of the world. Indeed, reflecting on the rest of the world, Tyler Cowen urges us to preface all discussions of inequality with a reminder that although economic inequality has been increasing in advanced industrialized nations, over the past two decades global inequality has been falling.16 And given global economic patterns, this is not a coincidence but a relationship.

Of course, in an ideal world everyone would have been even better off if the top 1 percent had taken home less than 13 percent of all the income and the bottom 20 percent had gained more—even while the economy grew at the same overall rate. Not to promote the best as an enemy of the good, there is nevertheless a convincing case to be made for social reforms that would to some degree shift the distribution of income away from the top. Progressives and conservatives generally agree on the need to rein in government transfers received by wealthy citizens, particularly the special benefits derived from the favorable tax treatment afforded to homeowners. These benefits, known as “tax expenditures,” allow home owners to deduct the interest paid on mortgages and to net up to $500,000 of capital gains tax-free on the sale of their homes.

The amounts are not trivial. The CBO estimates that the tax expenditures for mortgage-interest deductions amount to $70 billion, almost 73 percent of which goes to households in the top 20 percent of the income distribution, while those in bottom 20 percent receive no benefit. Although there would be some downside for the home-building industry, limiting tax subsidies to wealthy homeowners could lower the level of inequality without seriously adverse consequences for the rate of homeownership.

Yet even if these adjustments were made, much income inequality would still remain, which takes us back to the question: Could we ask for still more? Obviously, there are many ways for government to appropriate additional money from those in the upper-income brackets and deliver more to those on the bottom. Raising income taxes, lifting the ceiling on taxable income for Social Security, increasing the Earned Income Tax Credit and eliminating its marriage penalties, boosting the minimum wage, means-testing Social Security benefits, and taxing the fringe benefits of employment are among the evident alternatives. Then there are the less well-recognized but hardly trivial proposals to tax some classes of advertising and to eliminate the corporate income tax altogether in the context of comprehensive tax reform. Progressives and conservatives argue about whether any and all such measures would kill jobs or boost the economy, discourage work or stimulate activity, generate class conflict or enhance social solidarity, and advance social justice or deny the just deserts of individual merit. A vast literature on these issues has generated mixed findings about the implications of various measures.

Considering the uncertainty surrounding these issues, the degree of support for additional measures to spread the nation’s wealth is heavily influenced by one’s answer to the question: How serious is the problem of rising economic inequality amid abundance? The answer rests on competing ideas about the current state of material well-being in the United States, the integrity of free-market capitalism and, above all, the putative consequences of inequality.

Progressives tend to think that inequality is the story and that, as already noted, nearly everything wrong in U.S. society stems from it. But this argument ultimately depends on presumed maladies arising from inequality that more than stretch scientific criteria for medical causality. The evils ascribed to inequality expand roughly at the same rate as the DSM manual, and that is a suspicious thing.

As long as household incomes are increasing at every level (as measured by the CBO), conservatives are less concerned about rising economic inequality than progressives. They accept inequality as the tribute that equality of opportunity grants to merit, productivity, and luck in the free market, recognizing that this transaction is sometimes distorted by discrimination, exploitation, corruption, and outright larceny, which need to be checked by government. With the average family’s disposable household income in the United States among the highest in the world, inequality is perceived less as a source of social friction between the “haves and the have-nots” than as an imbalance between those who have a lot and others who have even more. This, on balance and seen in an historical perspective, ought to be a cause for celebration, not an occasion for mass self-flagellation.

1Vlastos, “Justice and Equality,” in Social Justice, edited by Richard Brandt (Prentice-Hall, 1962), p. 32.

2Frankfurt, On Inequality (Princeton University Press, 2015).

3“Real Personal Income for States and Metropolitan Areas, 2008-2012,” U.S. Bureau of Economic Analysis, April 24, 2014.

4Michael Forster et al., Society at a Glance 2011, (OECD 2011).

5“Partisan Polarization Surges in Bush, Obama Years: Trends in American Values: 1987-2012,” Pew Research Center, June 4, 2012.

6Piketty & Saez, “Income Inequality in the United States,” Quarterly Journal of Economics (February 2003).

7Burkhauser, “Presidential Address Evaluating the Questions that Alternative Policy Success Measures Answer,” Journal of Policy Analysis and Management (Spring 2011).

8Philip Armour, Richard V. Burkhauser, and Jeff Larrimore, “Deconstructing Income and Income Inequality Measures: A Crosswalk from Market Income to Comprehensive Income,” American Economic Review (May 2013). The government transfers included here involve both cash and in-kind benefits, specifically food stamps, housing subsidies, and school lunches, but not the value of employer- and government-provided health insurance. For an analysis of the income growth when cash transfers and health insurance are included, but not in-kind benefits, see Richard Burkhauser, Jeff Larrimore, and Kosali Simon, “A ‘Second Opinion’ on the Economic Health of the American Middle Class,” National Tax Journal (March 2012), pp. 7-32.

9Congressional Budget Office, The Distribution of Household Income and Federal Taxes, 2008 and 2009 (Government Printing Office, 2012). The major components of income included here differ from those recommended by the Canberra Group mainly in regard to capital gains, which the Canberra guidelines exclude from the measure of household income in favor of their treatment as changes in net worth.

10Congressional Budget Office, The Distribution of Household Income and Federal Taxes, 2010 (Government Printing Office, 2013).

11U.S. Treasury Department, Income Mobility in the U.S. from 1996 to 2005 (Government Printing Office, 2007). A similar rate of mobility was reported for those in the bottom quintile from 1986 to 1996. Unlike the CBO measure, these findings are based on pre-tax market income plus cash but not tax-exempt or in-kind transfers. Also, the unit of analysis is not adjusted for household size.

12Wilcox & Lerman, “For richer, for poorer: How Family Structures Economic Success in America,” AEI, October 28, 2014.

13The Distribution of Household Income and Federal Taxes, 2010. In 2010 the top 1 percent netted almost 13 percent of all the after tax income (15 percent before taxes).

14Peter Eavis, “Invasion of the Supersalaries,” New York Times, April 13, 2014.

15Dionne Searcey & Robert Gebeloffjan, “Middle Class Shrinks Further as More Fall Out Instead of Climbing Up,” New York Times, January 25, 2015. Rakesh Kochhar & Richard Fry, “America’s ‘Middle’ Holds Its Ground After the Great Recession,” Pew Research Center, February 4, 2015.

16Cowen, “Income Inequality Is Not Rising Globally. It’s Falling,” New York Times, July 19, 2014.

Neil Gilbert is Chernin Professor of Social Welfare at the University of California, Berkeley. This essay is adapted from his latest book, Never Enough: Capitalism and the Progressive Spirit (Oxford University Press, forthcoming